NFNV Nigeria: Towards inclusive, resilient recovery from Covid-19

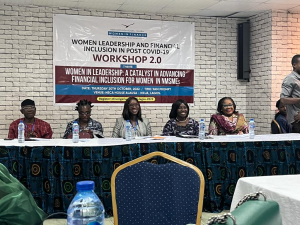

The recent New Faces New Voices Nigeria (NFNV-Nigeria) capacity building workshop on deepening women’s financial inclusion in Lagos, Nigeria, focused on building the participants’ resilience towards inclusive and sustainable recovery from the economic effects of the Covid-19 pandemic.

The workshop, which was held under NFNV Nigeria’s Women’s Leadership for Financial Inclusion and Economic Recovery (WLFI) Project, is the second in the WLFI workshop series and was themed: “Women in leadership: A Catalyst for advancing financial inclusion for women in NMSMEs.”

The first leg of the NFNV-WLFI workshop series was held in Kano last August which delved into various financing opportunities women entrepreneurs across formal and informal sectors could take advantage of to restart and boost their enterprises, post-Covid-19.

The Lagos workshop, which had in attendance stakeholders and experts in the finance and business sectors, focused on building the capacity of women business owners of Nano, Micro, Small and Medium Enterprises (NMSME) to build resilience and sustainably recover from the negative effects of the Covid-19 pandemic.

Mrs Aishatu Debola Aminu, Country Director of NFNV-Nigeria, while welcoming participants to the event, said the workshop was necessitated by the fact that women-owned SMEs in Nigeria were confronted with crippling challenges of access to finance, business skills, networks, markets and technologies, further aggravated by a double-digit inflation and a global recession.

“This workshop is specifically designed to provide participants with knowledge, skills and strategies to be resilient, scale up and thrive as women entrepreneurs in a post-Covid-19 economy that is volatile, uncertain, complex and ambiguous. Consequently, women entrepreneurs will be afforded the opportunity to reposition their businesses for productivity and profitability.

“We are aware that economies shrink when women are left out of economic activities. In this workshop, we want to generate the necessary evidence to demonstrate that alleviating women’s economic challenges through empowerment strategies is key to sustainable development,” Ms Aminu said.

Shiphra Chisha, director of programs at the Graca Machel Trust (GMT), while giving her goodwill message, said African women were predominantly drivers of economic and social development, yet they continue to grapple with complex challenges, hence the need to continuously amplify and create visibility for their challenges in decision-making spaces.

Ms Chisha cited a 2019 study by the Central Bank of Nigeria (CBN) which showed that financial exclusion stands at 36% among women and 24% among men in Nigeria. The CBN report also highlighted the relative gender gap in relation to financial inclusion which stands at 20-30%, placing Nigeria below its peers.

“Since 2012, although women’s exclusion has dropped, the gender gap has grown, revealing that men’s inclusion has improved more rapidly than women’s. The National Financial Inclusion Strategy (NFIS) was launched in 2012 with the aim of reducing financial exclusion to at least 20% among the adult population of the country. However, according to the revised NFIS, Nigeria has not been on track to achieve its targets,” she said.

Ms Chisha decried the prevalence of low-level literacy rates, lack of access to loans and grants, and other financial services and products particularly among women in the informal sector, which limits their capacity to grow their business portfolio and consequently inhibits women’s financial inclusion.

“Increasing women’s access to finance and other financial products, enhancing their capacity and skills as entrepreneurs as well as fast-tracking the number of women in leadership and decision-making positions in the financial sector will deepen women’s financial inclusion across board and boost their performance in business,” she said.

The GMT programs director also called on policymakers and development partners in Nigeria to develop sex- and age-disaggregated data to measure progress in financial literacy across urban and rural areas, through partnerships with fintech companies. She also urged the government to provide incentives for financial services providers to develop innovative solutions targeted at rural women as well as to adopt a segmented approach to reaching the informal sector.

Ms Carol Oyedeji, executive director, commercial banking, at Eco Bank Nigeria, said despite increased awareness creation campaigns by donor agencies, government and the private sector, the gender gap in financial services had persisted. She cited data by Global Findex which shows women were 15% less likely than men to own bank accounts, worldwide, adding that women-owned businesses have up to $320bn in unmet financing needs globally, according to the International Finance Corporation (IFC).

In addition, Ms Oyedeji said women in low and lower middle-income countries continue to grapple with domestic violence as a major socio-cultural challenge, which she described as an irony, considering the fact that women were also the major victims of financial exclusion. She therefore called on her fellow women to leverage their dynamism and unique ingenuity to close the financial inclusion gap and stay ahead of the curve.

“Women in sub-Saharan Africa typically earn a lower percentage than men for the same job and 26% of women are less likely to be working than men, just as a larger percentage of the jobs they get are low-paid and in the unofficial sector of the economy, making them susceptible to theft, sexual harassment, and discrimination. Yet, the Covid-19 pandemic has resulted in an unprecedented loss of jobs with women being the hardest hit, which has further widened the gender gap.”

The ECO Bank director described NMSMEs as essential to the development and expansion of developing economies because they hold the creative seeds that can revolutionize any economy, adding that women’s financial inclusion can be achieved through programs such as grantmaking, cash transfers, tax breaks, subsidies, palliative schemes as well as putting in place pro-women policies amongst others.

“Equal property rights for married women, women’s ability to pursue a career, seek a job or establish a bank without discrimination or prejudice are the most important issues. Thus, any culture or religion that tends to relegate God’s given rights and potential of women should be further re-assessed as it sets extra hurdles for women on the road to financial inclusion,” said Ms Oyedeji.

In his remarks, Dr. Ezra Yakusak, executive director of the Nigerian Export Promotion Council (NEPC), said the Council promotes the development and diversification of Nigeria’s export trade, assists in promoting the development of export-oriented industries as well as playing a leading role in the creation of export incentives to support the export sector.

While urging the participants to key into the NEPC support program for a successful export business, Dr Yakusak said the Council recently helped a batch of 40 exporters to receive a US Food and Drug Administration (FDA) certification for their products to access the US market, which will enable their products to compete with similar products from around the world and also stem the problem of rejection of Nigerian goods abroad.

He added that the NEPC also coordinates the participation of Nigerian companies in trade fairs and expos outside the country adding that programmes such as the She Trades Initiative, a 5-year programme of the International Trade Centre (ITC) funded by the then UK Department for International Development (DFID), is poised to boost economic growth and create jobs in Nigeria by increasing the participation of women-owned businesses in international trade.

Dr Yakusak also spoke on the NEPC’s Women in Export Development Programme (WEDP) as another viable opportunity for women in business to enhance their accessibility to resources and training on exportation which will allow Nigeria achieve quantum increase and diversification in non-oil exports as well as widely entrenching the export culture across every state in the country.

NFNV-Nigeria is a business and trade support organization whose main focus is enhancing the capacity of women in business and finance and building competent women business entrepreneurs and leaders in the formal and informal sectors towards achieving a financially inclusive society. Thus, the WLFI workshop series is a step in the right direction towards achieving the nonprofit’s vision.